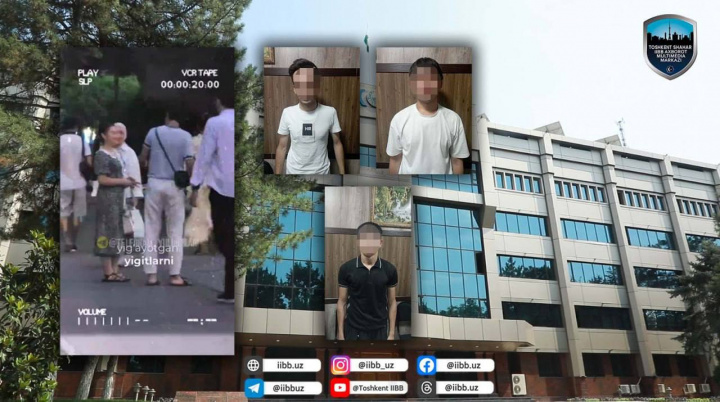

Intermediary real estate firms under investigation for allegedly embezzling billions of UZS

An investigation is underway against officials of “Credit House” and “In Fin Stroy Invest” LLC in Tashkent. These intermediary firms purchased apartments from construction companies and resold them to buyers on long-term installment plans. However, they are suspected of embezzling the buyers' payments. Victims who contacted Kun.uz expressed concerns about losing both their money and apartments.

Officials from “Credit House” and “In Fin Stroy Invest” LLC are under investigation. A group of affected buyers who reached out to Kun.uz claim that the scale of the issue is enormous.

“We signed a contract with ‘Credit House’ on February 8, 2024, for a property purchase. We made an initial payment of 100 million UZS. We have been making regular payments according to the agreed schedule. However, when we visited the construction site to check the progress, the head of the construction company informed us of a legal dispute with Credit House. They told us that ‘Credit House’ had not been transferring funds as per the agreement. This means they did not fulfill their investment contract obligations.

All we ask is for the money we paid to be transferred to the construction company. We don’t need anything extra. We are ready to deal with them directly because we have lost trust in these intermediaries,” said one of the complainants, Madalibek Hakimov.

Representatives of “Credit House” have assured buyers that the issue will be resolved soon but asked for more time. However, the victims, whose payments never reached the construction company, do not trust these promises.

One of the victims, who traveled from Zarafshan, Navoi region, said he had taken a loan to cover the initial payment.

“I came from Zarafshan. We signed a contract on July 9, 2024. I took an 80 million UZS loan for the initial payment. I am currently repaying 4 million UZS per month. However, they violated the contract terms. My monthly payment was supposed to be 3,531,000 UZS for 129 months.

Now, the construction company says the building will be completed in the fall and offered to arrange a mortgage. But if that happens, the total cost will increase. So far, I have paid 105 million UZS. I just want my money back — I am exhausted,” said Navoi-based teacher Abduvali Narziev.

Kun.uz reached out to Klara Tolipova, the head of “Credit House,” for comments. She stated that the issue arose because the company prematurely entered the secondary real estate market.

“The problem started because we moved into the secondary market a bit too early. If I’m not mistaken, we started making contracts for it around November. So far, we have signed around 100 contracts, out of which 40 buyers have already moved in, meaning their payments were fully transferred.

The bank was supposed to issue loans, but for some unknown reason, there was a delay. We have been trying to sort out the financial situation for the past two weeks.

We realized the problem on January 30. After complaints from the affected customers, we were taken to the district department of internal affairs and detained as suspects for 24 hours. Our documents and financial statements were reviewed. I also checked our accounts—there was no missing money or fraud. The problem occurred because the bank did not provide the loans on time, and we entered the secondary market too soon,” she explained.

Klara Tolipova also addressed the reasons why funds had not been transferred to the construction companies. She admitted that customers’ complaints were justified and such incidents had indeed occurred. However, she claimed that delays in transferring funds were due to issues related to the construction projects.

She further commented on the financial state of her company:

“Our financial assessments indicate that the future expected revenue of ‘Credit House’ is around $20 million. We receive 3-4 billion UZS in monthly installment payments. Out of this, 1 billion UZS is used to pay off ‘Credit House’s’ credit obligations, and the remaining 2 billion UZS is allocated for office rent, taxes, and payments to construction firms,” she stated.

Meanwhile, Gayrat Mirkamolov, the head of In "In Fin Stroy Invest" LLC, declined to provide a clear statement regarding the situation.

According to open sources, "Credit House" LLC, a company specializing in the wholesale trade of household goods, was officially registered in December 2018. Fifty percent of its shares are owned by "In Fin Stroy Invest" LLC.

"In Fin Stroy Invest" LLC was registered in September 2020 and is fully owned by "Invest Consult System" LLC.

"Invest Consult System" LLC, in turn, was registered in October 2017. Its sole founder and director is Robiya Galyamova.

How did the scheme work?

According to documents reviewed by Kun.uz, an individual named Shoira Rahimova signed an investment contract with "World Baraka Business," a construction firm, for nearly 90 apartments under a two-year installment plan. However, these contracts were then resold to buyers by "In Fin Stroy Invest" LLC with added markups under 10-year installment agreements.

Buyers paid their initial deposits and monthly installments directly to "In Fin Stroy Invest" LLC. However, the company failed to transfer these funds to the construction firm.

Information obtained by Kun.uz suggests that the issues surrounding "Credit House" and "In Fin Stroy Invest" LLC are not limited to their dealings with "World Baraka Business"—the problem is much bigger, and the number of affected individuals is significantly higher. The amount of money involved is estimated to be in the billions of UZS.

If it is proven that "Credit House" officials embezzled buyers’ funds, this case could become one of Uzbekistan’s largest real estate frauds, potentially resembling a financial pyramid scheme.

Kun.uz will continue monitoring the situation.

Recommended

List of streets and intersections being repaired in Tashkent published

SOCIETY | 19:12 / 16.05.2024

Uzbekistan's flag flies high on Oceania's tallest volcano

SOCIETY | 17:54 / 15.05.2024

New tariffs to be introduced in Tashkent public transport

SOCIETY | 14:55 / 05.05.2023

Onix and Tracker cars withdrawn from sale

BUSINESS | 10:20 / 05.05.2023

Latest news

-

Wizz Air to suspend flights from Uzbekistan to Abu Dhabi

POLITICS | 09:49

-

Catering businesses in Uzbekistan demand compensation for power outages

SOCIETY | 19:28 / 14.07.2025

-

Abdulaziz Kamilov takes charge as Presidential Advisor on Foreign Policy

POLITICS | 19:26 / 14.07.2025

-

Sardor Umurzakov appointed Presidential Advisor on Strategic Development

POLITICS | 19:25 / 14.07.2025

Related News

17:22 / 09.07.2025

Authorities bust criminal gang extorting money at Tashkent’s Farhod auto market

11:54 / 09.07.2025

Fake job promises abroad lead to arrests in Tashkent, Namangan, Fergana, and Andijan

15:15 / 07.07.2025

Scammers in Tashkent caught collecting money under fake interview scheme

17:10 / 04.07.2025