Uzbekistan’s Central Bank joins Islamic Financial Services Board to advance Islamic finance

The Central Bank of Uzbekistan has officially become a member of the Islamic Financial Services Board (IFSB), according to an announcement from the bank's press service.

Photo: KUN.UZ

The IFSB, established in 2002 and headquartered in Kuala Lumpur, Malaysia, is an international organization that develops standards for regulating and supervising Islamic financial institutions. It also aims to implement effective corporate governance, risk management systems, and capacity building within the sector. The board supports its members through research, training, and facilitating the adoption of global best practices.

Membership in the IFSB provides Uzbekistan with an opportunity to study international experiences and implement advanced regulatory practices for Islamic financial institutions in the country.

Significance of Islamic finance

Islamic finance operates in compliance with Sharia law, which emphasizes ethical values in financial transactions. Unlike traditional banking, it adheres to unique principles and norms, prioritizing compliance with Islamic guidelines. Legal expert Husayn Rajabov has pointed out that Islamic finance encompasses a broad spectrum of financial relationships beyond banking.

Uzbekistan has been exploring the development of Islamic finance since 2018. At a recent international forum in Tashkent, Apex Bank Chairman Bahrom Numanov highlighted that 20% of Uzbekistan's population refrains from using conventional credit systems due to religious reasons. Experts estimate that the introduction of Islamic finance in Uzbekistan could attract nearly $10 billion in investments and create over 100,000 new jobs.

Regional and global collaboration

With its new membership, Uzbekistan joins other Central Asian nations such as Kazakhstan, Kyrgyzstan, and Tajikistan, whose financial regulators are already members of the IFSB. The board currently comprises 188 members, including 81 regulatory bodies, 10 international intergovernmental organizations, and 97 market participants.

Uzbekistan is also drafting legislation to establish an Islamic finance system in the country. If passed, it would require extensive amendments to existing laws, signaling a major step toward diversifying and modernizing the nation’s financial landscape.

Related News

16:37 / 24.04.2025

Uzbekistan sells $3.6 billion worth of gold in three months, making up 44% of total exports

16:05 / 24.04.2025

Central Bank keeps key interest rate unchanged at 14% per annum

13:33 / 17.04.2025

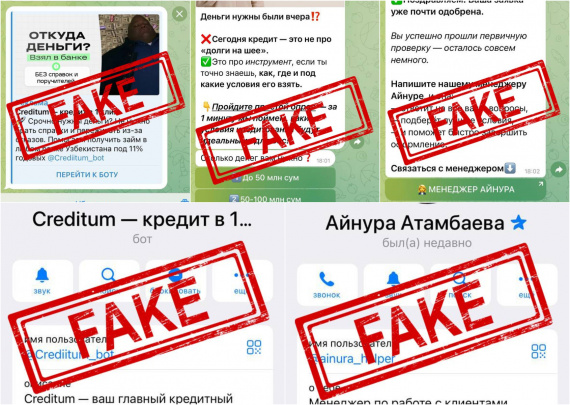

Scammers target Telegram users with fake loan offers, Central Bank warns

20:17 / 16.04.2025