Swiss Bank Lombard Odier accused of money laundering in Gulnara Karimova case

Photo: Bloomberg

Swiss federal prosecutors have charged Lombard Odier, one of the country’s most prestigious private banks, and a former employee with serious crimes related to money laundering. According to the prosecution, the bank played a "crucial role" in concealing the alleged criminal activities of Gulnara Karimova, the late Uzbek President Islam Karimov’s daughter. The allegations were reported by the Financial Times on November 29.

Karimova is accused of amassing billions of dollars through extortion and misappropriation while controlling lucrative government contracts in Uzbekistan. Prosecutors claim that she funneled these proceeds through a Switzerland-based entity called The Office. These accusations follow similar charges brought against Karimova in 2023, which alleged systematic bribery from international companies hoping to secure deals in Uzbekistan.

Lombard Odier is accused of failing to adhere to anti-money laundering standards and internal compliance rules, enabling Karimova to legitimize illicit funds. Swiss authorities state that the bank’s negligence allowed billions in questionable transactions to flow unchecked.

Lombard Odier has strongly refuted the charges. In a statement, the bank emphasized that it had independently reported concerns about Karimova to Swiss anti-money laundering authorities over a decade ago, prompting the investigation. "The allegations against the bank are unfounded. We plan to defend ourselves. Since 2012, the bank has fully cooperated with the relevant authorities," the statement read.

Despite its early cooperation, the bank became subject to criminal liability in 2016, when Swiss police discovered expensive jewelry and significant documentation during a raid on safety deposit boxes linked to Karimova. These findings were allegedly purchased using Uzbek state funds.

Swiss prosecutors have also charged a former Lombard Odier employee, whose identity remains undisclosed under Swiss law. Before joining the bank in 2008, the individual reportedly worked for Karimova and later exploited internal compliance vulnerabilities to facilitate her transactions. This person left the bank in 2012, coinciding with Lombard Odier’s formal disclosure of concerns about Karimova to authorities.

Karimova’s financial dealings have drawn scrutiny beyond Lombard Odier. She is tied to one of Switzerland’s largest bankruptcy cases involving Zeromax, a conglomerate based in Zug that collapsed in 2010, leaving $4.6 billion in debts. Creditors allege that Karimova used the firm for personal enrichment. A significant portion of her wealth remains frozen in Swiss bank accounts as investigations continue.

Related News

16:06 / 29.04.2025

Uzbekistan to draft new laws targeting money laundering, insider trading, and tax evasion

13:33 / 17.04.2025

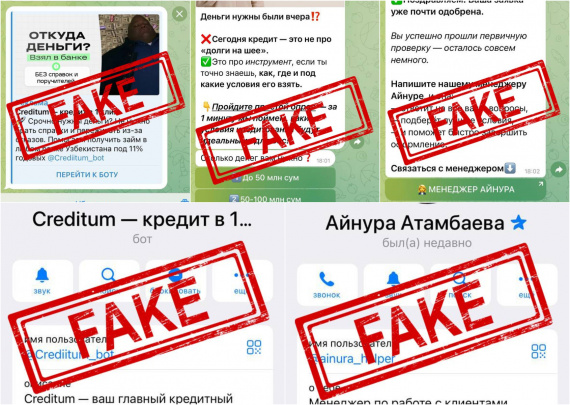

Scammers target Telegram users with fake loan offers, Central Bank warns

18:33 / 12.04.2025

Uzbekistan's consulate in Istanbul warns citizens of fake job offers in Türkiye

12:14 / 08.04.2025