Gov't plans to abolish VAT exemptions in all areas with the exception of newspapers, pharmaceuticals and books

Value-added tax (VAT) benefits will remain only for activities related to pharmaceuticals, books and newspapers.

This was announced by the Deputy Chairman of the State Tax Committee (STC) Mubin Mirzayev on June 12 during a briefing at the Agency for Information and Mass Communications.

“Our goal is to preserve benefits in socially important areas, in particular, pharmaceuticals, books and newspaper-related activities. It will take effect on January 1, 2020,” Mirzayev said.

Earlier, the founder of korzinka.uz Zafar Khashimov said that if the VAT rate was set at 12% (now 20%) and all benefits and exemptions were canceled, much fairer, business-friendly system would appear in Uzbekistan.

An economist Yuli Yusupov agrees with him. He drew attention to the fact that if the VAT exemption had been eliminated, the tax could be reduced as much as 12% without any losses to the budget.

Related News

17:15 / 30.01.2025

Citizens sold nearly $1 million worth of solar-generated electricity in 2024

14:08 / 30.01.2025

Pharmaceutical startups to receive venture funding under new initiative

13:39 / 30.01.2025

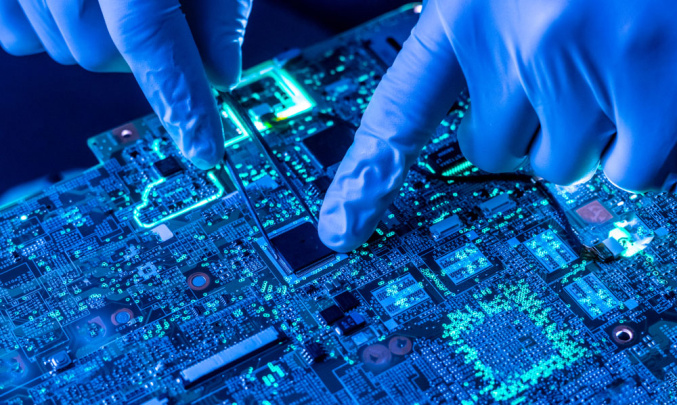

Gov't introduces tax benefits for manufacturers of high-tech products

13:47 / 22.01.2025