Uzbekistan ranked among top 10 global gold buyers

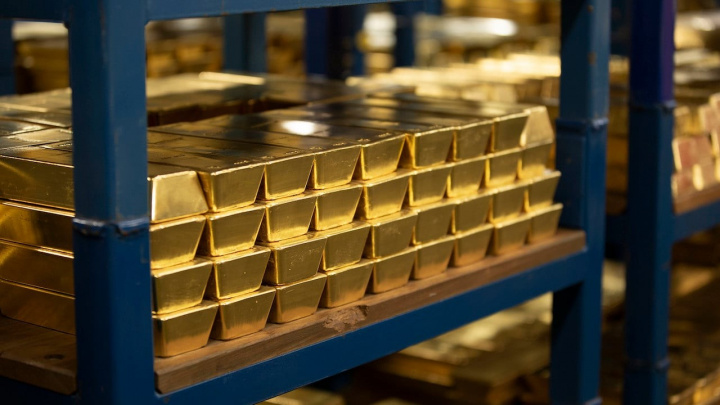

In 2024, global gold demand reached a record 4,974 tons, a 1% increase from the previous year, driven by strong purchases from central banks and investor interest, according to the World Gold Council (WGC).

Amid this surge, Uzbekistan’s gold production grew by 8%, fueled by higher output at the Almalyk Mining and Metallurgical Complex (AMMC) and Navoi Mining and Metallurgical Company (NMMC). The country's central bank also made net purchases of 11 tons of gold, securing its place as the ninth-largest gold buyer globally.

In November, the Central Bank of Uzbekistan, along with Poland, became one of the two largest gold buyers in the world. The WGC noted that the drop in gold prices after the U.S. elections may have encouraged some central banks to make additional purchases.

Key Trends: For the third consecutive year, central banks bought over 1,000 tons of gold. Among the largest buyers were Poland (90 tons), Türkiye (75 tons), and India (73 tons).

Investment demand for gold surged by 25%, reaching 1,180 tons. The annual demand for bars and coins remained stable, while gold ETFs, for the first time since 2020, did not experience significant outflows.

The average gold price in 2024 was $2,300 per ounce (+23%), and in the fourth quarter, it reached a record high of $2,600 per ounce.

Overall gold production grew by 1%, reaching 3,661 tons, while gold recycling increased by 11%, totaling 1,370 tons. Total gold supply amounted to 4,974.5 tons (+1%), and demand reached 4,553.7 tons (+1%).

Outlook for 2025: Experts predict that demand for gold will remain high in 2025. Central banks are expected to continue building up reserves, while investors will increasingly turn to gold as a safe-haven asset amid economic instability. At the same time, jewelry demand is likely to be under pressure due to high prices.

Uzbekistan's gold market will be influenced by domestic macroeconomic factors, including currency policies, inflation, and the state of export markets. With the global trend of strengthening gold reserves continuing, Uzbekistan may continue its strategy of accumulating gold as a key asset.

Related News

19:31 / 14.03.2025

Gold hits new peak as central banks ramp up purchases

19:24 / 11.03.2025

Central Bank purchases $100 million in US bonds in February

19:43 / 07.03.2025

Uzbekistan’s foreign exchange reserves hit a record $45 billion in February

20:04 / 05.03.2025