Real estate transactions in Uzbekistan decreased in 2024 – Central Bank

In 2024, real estate transactions in Uzbekistan experienced a slight decline, with five regions—including Tashkent—seeing slower activity in both home sales and rentals. A market analysis report for the fourth quarter, prepared by the Department of Consumer Protection at the Central Bank, highlights that this slowdown reflects a market correction after the rapid growth of previous years.

Photo: Spot

In most regions, activity either decreased or remained at the same level as the previous year. As a result, demand for real estate stabilized, and housing prices increased at a more moderate pace.

During the October-December period, market activity showed slight acceleration, continuing the moderate growth observed in the third quarter. For example, in the fourth quarter, the number of real estate transactions reached 81,800 units (+5.6%). However, for the entire year, the number of sales transactions declined by 2.2%, totaling 329,000.

The decline in transactions was observed in the Navoi, Tashkent, Bukhara, Namangan regions, and Tashkent city. In the Syrdarya, Fergana, and Kashkadarya regions, activity remained almost unchanged from 2023. Other regions experienced moderate growth.

The Central Bank noted that in the fourth quarter, the monthly number of real estate contracts shifted to positive growth.

"Despite the continued socio-demographic and economic factors that support demand and activity in the real estate market, the more moderate growth rates in mortgage lending, the relatively high growth in construction, and some saturation in demand were key factors in shaping housing prices, contributing to a slowdown in the rate of housing price increases," concluded the analysts from the Central Bank.

In 2024, the number of mortgage borrowers in Uzbekistan decreased by 16%, totaling 58,800 individuals. The average loan size increased by 18%, surpassing 290 million UZS. The share of the primary market grew, while the proportion of young mortgage borrowers decreased.

Related News

10:07 / 14.03.2025

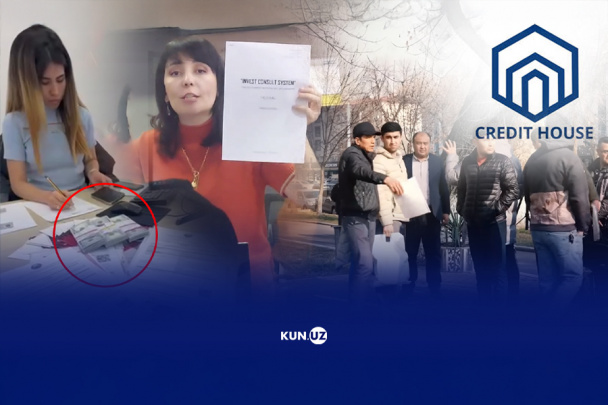

Broken promises: How 'Credit House' left buyers homeless

11:27 / 11.03.2025

More Uzbek citizens purchasing real estate in Russia as foreign demand rises

18:49 / 10.03.2025

Uzbek national secures Seoul’s most expensive apartment in landmark deal

12:04 / 07.03.2025