Over 12 million cyberattacks recorded in Uzbekistan in 2024

In 2024, Uzbekistan reported over 12 million cyberattack attempts, according to the Cybersecurity Center, marking an increase from 11 million in 2023. Alongside this, fraud cases surged by 34%, with around 35% of all fraud-related complaints linked to payment card scams. Cybercriminals are using a range of tactics to steal money, including malicious apps and the "Hello, Mom" scam. What are the most common scams, and how can you protect yourself from falling victim? Here's a detailed overview from Kun.uz.

One of the primary reasons for the rise in fraud is the growing number of bank card users. At the start of the year, there were fewer than 40 million bank card users in Uzbekistan, but that number has since exceeded 55 million.

Identifying the criminals and recovering stolen funds from cyber fraud is extremely difficult. This is because fraud can be committed from anywhere in the world, making the identification process more complicated.

Fraud trends

Fraud became more prevalent after the pandemic when online services saw a significant increase in use. In the past, most fraud occurred through phone calls, where criminals impersonated bank employees and asked victims to enter one-time codes received via SMS. This allowed the criminals to access banking information. However, the share of such schemes has drastically decreased from 95% to about 12-13%.

Today, most complaints are related to viral programs distributed through APK files via the Telegram messenger. Users often download these unknown files, thinking they're useful apps. Once installed, these programs request critical permissions, such as access to SMS messages, phone calls, and contact numbers. The gathered information is then sent to the criminals' servers.

The "Hello, Mom" scam

Another widespread fraud method is the "Hello, Mom" scam. In this scheme, criminals pretend to be a "relative" involved in a traffic accident, asking for money to resolve the issue. This type of fraud has been common in Tashkent, particularly among Russian-speaking residents. It's believed that the criminals behind this scam operate from outside the country, which is why Uzbek-speaking individuals are less frequently targeted.

Victims of this scam are often addressed by name, and personal details such as their home address are mentioned, which makes it more convincing. However, such information can be easily obtained, even online.

Fake transfer scam

A common trick involves receiving an SMS notifying you that money has been credited to your bank account. Shortly afterward, an unknown caller claims that the money was transferred to you by mistake and asks you to return it.

These criminals attempt to stir sympathy by telling emotional stories — such as claiming that these are their last funds, they’ve lost their job, or they need money for medical treatment. This is all an attempt to distract you. In some cases, the scammer may offer to let you keep a small portion of the money as a "bonus" for your help.

In such situations, never send money under any circumstances. Instead, contact your bank to confirm if a mistake has occurred.

How to protect yourself from fraudsters

Always check the source of information carefully, and pay attention to the web address of any page you visit. Think critically. Most fake news stories are designed to provoke strong emotions like fear or anger.

Criminals often use psychological tactics to manipulate their victims, creating a sense of urgency and demanding immediate action. They might threaten you with issues such as account changes, fines, or legal consequences, all in an attempt to pressure you into compliance.

Recently, there have been cases where fraudsters impersonate employees of well-known companies or government organizations. By using official language, they create an illusion of trust and security.

Criminals may call you, pretending to be bank representatives, claiming that someone is attempting to withdraw money from your account. They will urge you to immediately transfer funds to a "safe account" to avoid problems. Never follow these instructions: do not transfer any money, do not install suspicious apps, and never click on links provided.

Also, never share personal information or bank card details, including your CVC/CVV (the three-digit code on the back of your card), PIN codes, or any verification codes. Remember, legitimate companies will never ask you for passwords or access codes over the phone or via SMS.

Related News

10:07 / 14.03.2025

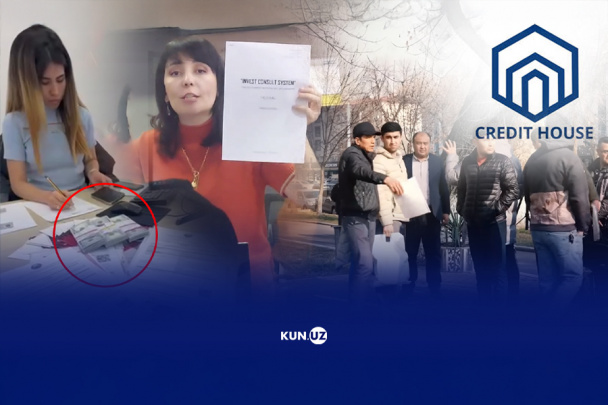

Broken promises: How 'Credit House' left buyers homeless

12:26 / 12.03.2025

Uzbekistan’s cybercrime crisis: How scammers steal millions and evade capture

10:54 / 11.03.2025

Authorities prevent circulation of $195,000 in counterfeit US dollars

12:10 / 28.02.2025