Fraudulent loan cases in Uzbekistan increased by 42% in 2024

The Ombudsman has reported a significant rise in fraud cases involving unauthorized loan processing, prompting an increase in lawsuits to annul credit agreements.

In 2024, the Human Rights Commissioner (Ombudsman) of the Oliy Majlis received over 6,000 complaints concerning the economic rights of citizens, with 9% of these linked to fraudulent activities.

A notable trend is the sharp increase in cases where loans were issued in the names of citizens without their consent, using their personal data. While there were 110 such complaints in 2023, this number surged by 42% in 2024.

In 60% of the complaints, individuals posing as employees of the company Click or the Central Bank were implicated. In some instances, up to 6 loans were fraudulently issued in the name of a single citizen across various commercial banks.

In response to these complaints, investigators from the internal affairs authorities directed commercial banks to recognize the affected citizens as civil plaintiffs, as they did not utilize the loan funds. They also recommended suspending the accrual and collection of interest on the loans until the culprits were identified. Despite these directives, banks continue to demand repayment from the affected individuals.

The Ombudsman has taken legal action by filing 5 lawsuits in civil courts, resulting in the invalidation of the fraudulent credit agreements. In one successful case, the funds issued in the name of a citizen were returned, and compensation for moral damages was awarded.

"The rise in complaints is largely attributed to the public's carelessness, inadequate information security measures, and insufficient economic knowledge," the statement highlighted.

According to the Ombudsman's press service, citing data from the Central Bank, 463 cases of fraudulent online loans issued in the names of citizens in 2024 resulted in material damages amounting to approximately 15 billion UZS.

To enhance information security and protect against fraud, citizens are strongly urged to adhere to the following precautions:

- Do not share personal data such as passport details, bank card numbers, and PIN codes with anyone;

- Avoid transferring personal information on social networks or to unfamiliar individuals;

- Do not disclose confirmation codes, passwords, or login details for banking applications received on your phone;

- Do not download unfamiliar files, documents, or links received via social networks or email;

- Do not answer calls or video calls from unknown numbers, especially foreign ones;

- Verify identities through official channels if someone claims to be an employee of a bank or another organization.

Related News

10:07 / 14.03.2025

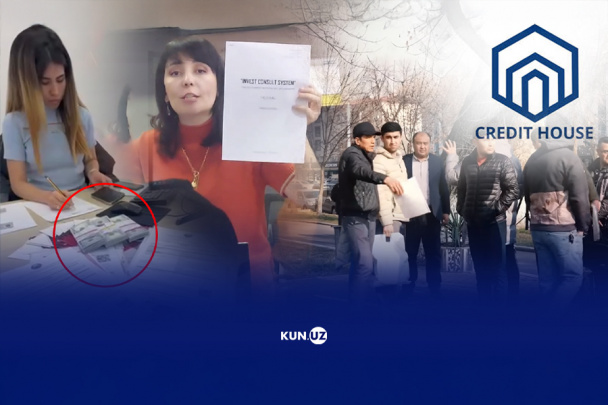

Broken promises: How 'Credit House' left buyers homeless

12:26 / 12.03.2025

Uzbekistan’s cybercrime crisis: How scammers steal millions and evade capture

10:54 / 11.03.2025

Authorities prevent circulation of $195,000 in counterfeit US dollars

12:10 / 28.02.2025