Central Bank blocked stolen funds amounting to 9.5 billion UZS last year

In 2024, the Central Bank of Uzbekistan successfully blocked stolen funds totaling 9.5 billion UZS, following over 2,500 requests from law enforcement agencies regarding fraud cases. The regulator received requests for information covered by banking confidentiality and processed 460 inquiries specifically related to fraud.

Thanks to swift action by banks based on the Central Bank's directives, the stolen funds were frozen on bank cards where fraudulently obtained money had been deposited.

The agency also outlined some of the most common fraud schemes. For example, fraudsters use spoofed phone numbers with SIP technology to impersonate bank employees, payment service providers, Central Bank officials, or law enforcement agents. In some cases, they access and use personal information of citizens obtained through malicious apps installed on the victims' phones.

The fraudsters then claim that the victim's money is "at risk" because someone is attempting to apply for a loan in their name. Following this, another fraudster posing as a security expert from the Central Bank contacts the victim, presenting false identification to gain their trust.

To counteract these threats, the Central Bank is implementing several anti-fraud measures. For example, during audio or video calls, the functionality of banking mobile apps is limited. Additionally, registration and login from devices outside Uzbekistan are only permitted within the country's borders.

Moreover, new users registering on the mobile platforms of banks and payment institutions face a one-hour restriction on using linked bank cards.

Related News

19:31 / 14.03.2025

Gold hits new peak as central banks ramp up purchases

10:07 / 14.03.2025

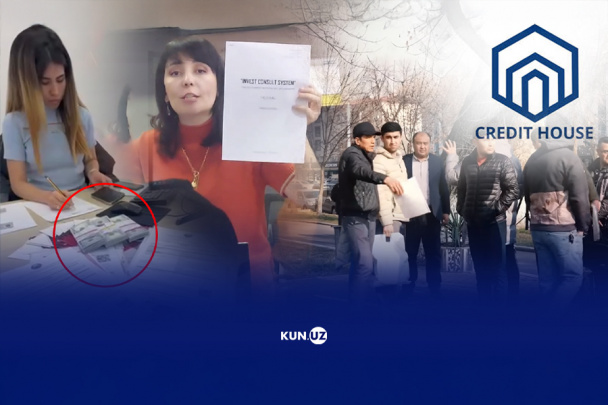

Broken promises: How 'Credit House' left buyers homeless

12:26 / 12.03.2025

Uzbekistan’s cybercrime crisis: How scammers steal millions and evade capture

19:24 / 11.03.2025