Central Bank and its role in shaping the economy

Central banks are one of the most important backbone structures of a nation’s economic and financial stability due to their responsibilities and functional roles. Central banks affect the countries’ or monetary unions’ macroeconomic and microeconomic factors through policy interventions, thereby affecting overall economic performance and strength.

On December 11, 2024, the Central Bank of Uzbekistan experienced a major leadership change. Timur Ishmetov was appointed as the new chairman, succeeding Mamarizo Nurmuratov, who led the bank from 2017 to 2024.

Nurmuratov’s term was marked by significant economic transformations in Uzbekistan, including the liberalization of foreign currency exchange. However, challenges such as inflation management remain pressing. Ishmetov, with his prior experience in several key positions at the Central Bank and as Minister of Finance from 2020 to 2022, is expected to continue the reforms.

The Central Bank of Uzbekistan plays a pivotal role in shaping the country's overall economic and financial landscape. While opportunities and positive trends in indicators such as GDP growth, rising investments, and increased consumption offer promising prospects, challenges persist in areas like inflation, risk management, and other critical domains. This leadership change might mark a turning point for the Central Bank's role in navigating these opportunities and addressing the challenges ahead.

Historical evolution of the Central Bank of Uzbekistan

In Uzbekistan, the evolution of the Central Bank aligns with the country’s transition from a centrally planned economy to a market-oriented system, which began in 1991 following the country’s independence.

The law "On Banks and Banking Activity" established a two-tier banking system, with the Central Bank serving as the main regulator of commercial banks. In 1994, the introduction of the soum, Uzbekistan’s national currency, granted the Central Bank complete authority over monetary and credit policies.

In subsequent years, the Central Bank of Uzbekistan modernized its operations, aligning itself with international banking standards, including adopting Basel recommendations. Over time, the institution has become more adept at navigating the global financial landscape, undertaking reforms that have gradually increased the financial system's stability.

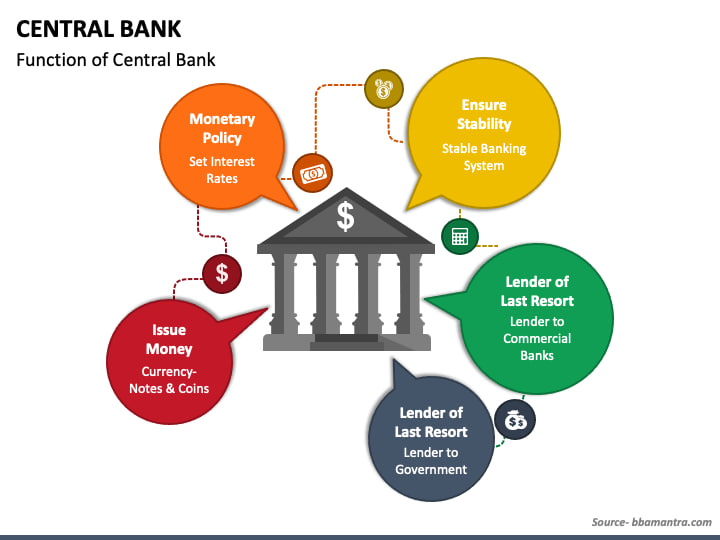

The roles of the Central Bank

The Central Bank serves as the primary financial institution of a country or monetary union. It oversees monetary policy, manages the money supply, and regulates the banking system. Unlike commercial banks, the Central Bank acts as an authoritative entity, serving as a banker to the government by providing funding and offering economic policy guidance.

Key responsibilities of central banks include:

- Formulating and implementing monetary policy to maintain low and stable inflation and support steady GDP growth.

- Affecting interest rates and regulating borrowing and lending costs through open market operations.

- Acting as a lender of last resort and setting reserve requirements for commercial banks.

Monetary policies and economic indicators

The policies of the Central Bank revolve around controlling interest rates, targeting inflation, which in turn affects GDP and its growth, and including exchange rate interventions in its policy areas. The Board of the Central Bank of Uzbekistan meets eight times per year to discuss key events and adjust monetary indicators, with the outcomes shared in official press releases. These releases provide valuable insights into the economic and financial landscape of the country.

For instance, on July 26, 2024, the policy rate was reduced by 0.5 percentage points to 13.5% per annum — the lowest rate since 2016. This rate influences the cost of short-term money (as measured by UZONIA, an overnight interest rate indicator) in the interbank money market and serves as a target for interest rates on interbank deposits and loans.

According to the Central Bank’s press release, the downward trend in core inflation and inflation expectations led to the rate reduction. Nonetheless, the Central Bank is committed to maintaining a tight monetary policy, which could indicate the possibility of raising the policy rate to keep inflation towards the target of 5%.

Subsequently, future policy decisions will depend on inflation trends, macroeconomic data, inflation expectations, and other areas, including external events and political developments.

Interconnectedness of Uzbekistan’s economy and Central Bank policies

Central banks play a crucial role in shaping economic dynamics, as seen during the 2007–2008 Global Financial Crisis. By controlling the money supply, they influence inflation, interest rates, and exchange rates, which affect consumer spending, investment, and trade competitiveness. These factors directly impact GDP growth and the balance of payments.

The crisis highlighted the importance of prudential policies like Basel III, which strengthened banks’ capital and risk management. Such measures have since improved financial stability, reducing the risk of systemic crises and ensuring a more resilient global financial system.

The Financial Stability Report by the Central Bank of Uzbekistan for 2024 highlights key developments in Uzbekistan's banking system:

According to the report, the capital adequacy ratio stood at 17.3%, and the Tier 1 ratio at 14.2%, both exceeding minimum regulatory requirements, as well as a rise in high-quality liquid assets and reduced reliance on unstable funding have strengthened liquidity conditions, while tightened macroprudential policies have moderated the growth of car loans, the real estate market shows signs of overvaluation due to supply-demand imbalances.

Current opportunities and challenges

According to forecasts, Uzbekistan's economy is poised for robust expansion, with real GDP projected to grow by 6–6.5% in 2024. Several factors underpin this optimistic outlook:

- High investment activity: The growth of investments across various sectors are one of the key factors for economic growth.

- Rising household incomes: Increased wages and higher cross-border remittances boost household income which in turn increases consumer spending supporting aggregate demand.

- Resilient banking sector: The banking system has demonstrated stability, with the capital adequacy ratio at 17.3% and the Tier 1 ratio at 14.2%, both well above regulatory minimums. Additionally, the rise in high-quality liquid assets and the decline in unstable funding sources reflect improved financial health.

- Retail sectors rise: Strong consumer demand has driven substantial growth in the services and retail sectors. The expansion in these areas contributes positively to the GDP growth, by stimulating business activities and job creation.

However, challenges persist. Inflation remains high, driven by robust consumer demand and supply-side constraints, particularly in the energy and real estate sectors. Other critical issues include:

- External risks: Long-term financing costs, potential secondary sanctions, and the impact of climate change pose significant threats to economic stability.

- Internal risks: The housing market shows signs of overvaluation due to supply-demand imbalances, while the rapid growth of microdebt could threaten financial stability.

Expert opinions

Saodat Umarova, the head of the social-economic department at CPR (Center for Progressive Reforms), highlights the existence of both challenges and opportunities that lie ahead for the new leadership to tackle. There is a need for bringing innovative strategies and market mechanisms to address structural inefficiencies.

She mentions three areas that need further alignment:

• Managing inflation while maintaining a stable currency.

• Balancing external debt and foreign exchange reserves.

• Promoting private sector competitiveness in a market with high costs and limited industrial diversification.

The adoption of more flexible monetary polies to address the fluctuations, along with measures to support private sector with credit access, and ensure transparency in regulations to improve investors’ confidence are possible ways to tackle these issues, according to the expert.

Farkhodjon Kholmamatov, a professor at the Tashkent Institute of Finance, recommends implementing robust risk management practices, including credit assessment, monitoring, and mitigation, along with training and capacity-building initiatives in these areas to address internal risks. He also advocates for measures to address non-performing loans, strengthening regulatory oversight through stress tests and scenario analyses, and improving governance and transparency.

Additionally, he puts the emphasis on the importance of financial literacy and inclusion are crucial to developing the sector and expanding access to services and resources for the wider population.

In general, central banks are at the intersection of state institutions and financial systems, they function as both bureaucratic banking organizations and operate within private markets.

The Central Bank of Uzbekistan is the center of the country’s economic and financial path. Although it has achieved much in stabilizing the economy and opening up some key industries, inflation, external and internal risk management are still issues.

Under the new leadership, the Central Bank faces a pivotal moment. Successfully addressing inflation while fostering continued economic growth will require carefully calibrated policies. The continued development of financial markets, greater private sector involvement, and improved risk management will be essential for ensuring Uzbekistan's long-term economic resilience.

Moreover, developing effective expectation management tools, particularly in the context of monetary policy and its impacts on inflation, will be crucial. As the financial system continues to evolve, the Central Bank’s ability to navigate these challenges will significantly influence the country’s trajectory.

Aziza Normurodova

Recommended

List of streets and intersections being repaired in Tashkent published

SOCIETY | 19:12 / 16.05.2024

Uzbekistan's flag flies high on Oceania's tallest volcano

SOCIETY | 17:54 / 15.05.2024

New tariffs to be introduced in Tashkent public transport

SOCIETY | 14:55 / 05.05.2023

Onix and Tracker cars withdrawn from sale

BUSINESS | 10:20 / 05.05.2023

Latest news

-

Uzbekistan’s population reaches 37.7 million: Men slightly outnumber women

POLITICS | 14:06

-

EU commits to long-term cooperation with Central Asia on transport, energy, and innovation

POLITICS | 14:03

-

Investigation closed: Authorities deny torture after man taken for interrogation dies in custody

SOCIETY | 13:10

-

Greenery disappears as road expands: Tree uprooting in Boysun sparks public outcry

SOCIETY | 13:08

Related News

12:16 / 04.04.2025

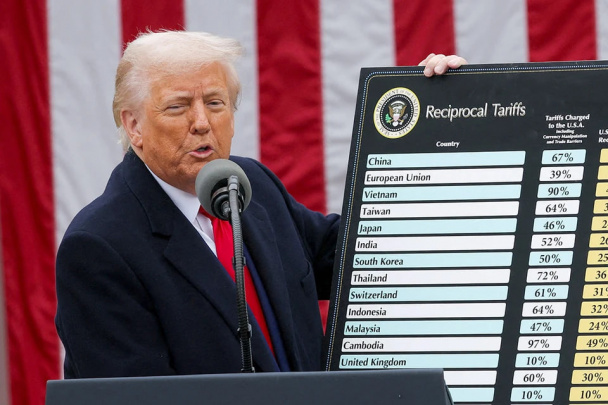

Uzbekistan may feel secondary effects of Trump’s global tariff policy

15:50 / 03.04.2025

Trump imposes 10% baseline tariff on all imports, raising economic uncertainty

19:17 / 02.04.2025

Uzbekistan sees 20% increase in budget revenue in Q1 2025

13:07 / 02.04.2025