Central Bank warns against sharing OTP codes to prevent fraud

The Central Bank has issued a formal statement to clarify recent concerns circulating on social media regarding unknown phone calls allegedly leading to automatic withdrawals from bank cards.

According to reports on social networks, some citizens claimed that answering calls from unknown numbers resulted in the unauthorized withdrawal of funds from their bank cards. The Central Bank has officially addressed these allegations.

Verification and security measures

The Central Bank explained that when a citizen registers on a mobile application of a commercial bank or payment system, they provide their phone number and enter a confirmation code received via SMS. Additionally, users may be required to undergo biometric verification to confirm their identity. After successful registration, users can link their bank card to the mobile application.

To link a bank card, a one-time password (OTP) is sent to the phone number associated with the card. The card is linked to the application only if the user enters the OTP correctly. The phone number provided during the registration process must match the one linked to the bank card. Otherwise, the application will reject the card linkage.

Furthermore, commercial banks and payment organizations restrict the use of newly registered bank cards in mobile applications for up to one hour to enhance security.

Risks of unauthorized withdrawals

The Central Bank emphasized that funds can only be withdrawn unlawfully if users:

- Share their login credentials, passwords, or OTP codes with third parties (fraudsters).

- Install harmful APK files distributed via messengers on their mobile devices.

“Answering calls from unknown numbers alone cannot result in unauthorized withdrawals from bank cards,” the Central Bank stressed.

Recommended

List of streets and intersections being repaired in Tashkent published

SOCIETY | 19:12 / 16.05.2024

Uzbekistan's flag flies high on Oceania's tallest volcano

SOCIETY | 17:54 / 15.05.2024

New tariffs to be introduced in Tashkent public transport

SOCIETY | 14:55 / 05.05.2023

Onix and Tracker cars withdrawn from sale

BUSINESS | 10:20 / 05.05.2023

Latest news

-

Uzbekistan's consulate in Istanbul warns citizens of fake job offers in Türkiye

SOCIETY | 18:33 / 12.04.2025

-

MIA clarifies rules on delayed traffic fine notifications

SOCIETY | 13:03 / 12.04.2025

-

“Helping neighbors is a moral duty” – Tokayev vows support for neighbors and balanced foreign policy

SOCIETY | 11:53 / 12.04.2025

-

MP Alisher Kadirov proposes stricter laws against online defamation and manipulation

SOCIETY | 11:38 / 12.04.2025

Related News

18:33 / 12.04.2025

Uzbekistan's consulate in Istanbul warns citizens of fake job offers in Türkiye

15:21 / 10.04.2025

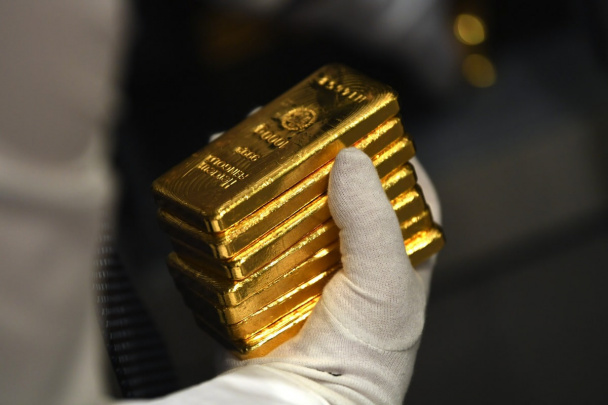

Central Bank reports record daily surge in gold bar prices

18:40 / 08.04.2025

Uzbekistan becomes world’s largest gold seller in February — WGC

12:14 / 08.04.2025