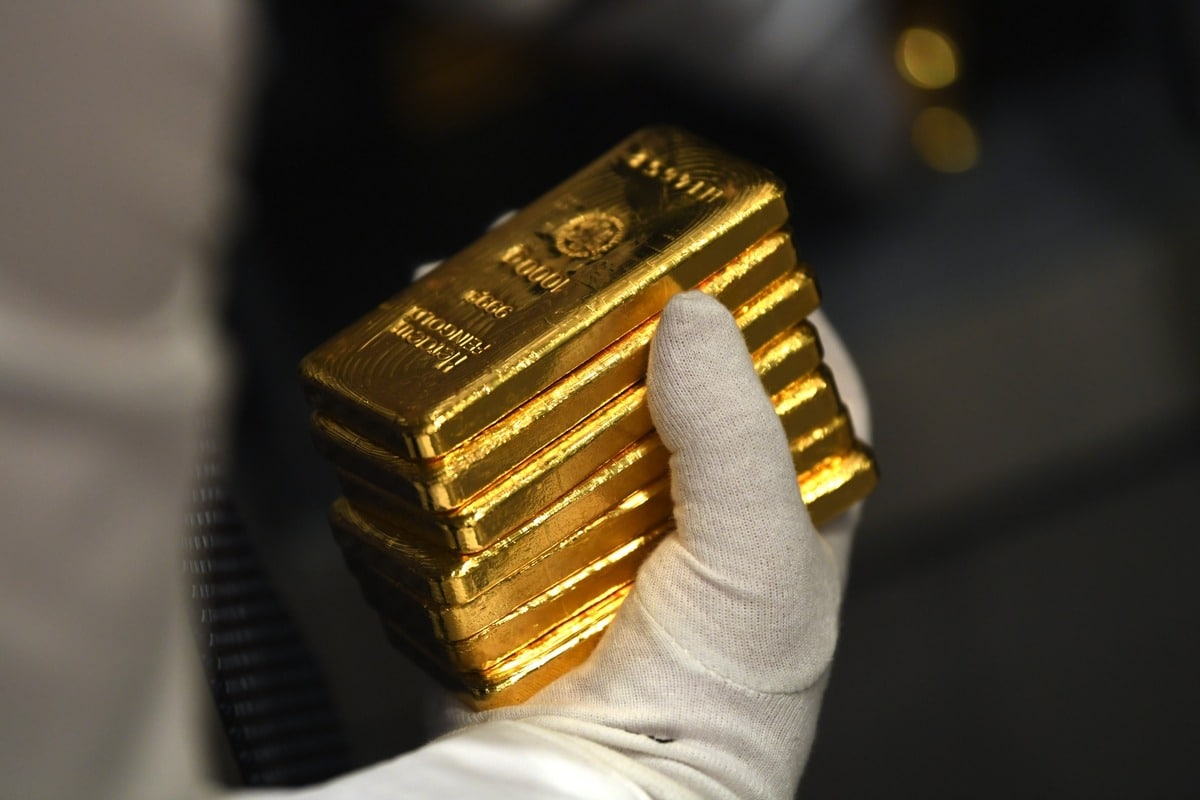

Central banks of the world countries purchased a record amount of gold in the third quarter, nearly 400 tons, four times more than the same period last year, World Gold Council (WGC) writes.

Uzbekistan, with 26 tons, is in second place in terms of gold purchases for reserves, slightly behind Türkiye (30 tons). Some central banks have not disclosed their figures, so buyers of more than 300 tons remain unknown.

Since the beginning of the year, central banks have purchased 673 tons of gold. This is the highest amount since 1967.

It should be noted that gold prices fell by 8% in the third quarter. Gold was traded below $1,650 an ounce yesterday. Since mid-April, world gold prices have been steadily declining. Against this background, since March, the Central Bank of Uzbekistan has stopped selling gold abroad.

The high interest in gold from the central banks is supported by high inflation and the expected recession in the global economy in 2023.

In the near future, high interest in gold from central banks and private investors will continue, market participants believe. This will be facilitated by inflationary, macroeconomic and geopolitical risks.