“Budget for Citizens” for 2022 published

The Ministry of Finance has published an information publication “Budget for Citizens”, dedicated to the draft state budget for 2022.

Photo: iStock

Readers can familiarize themselves with the main macroeconomic indicators that are expected for the current year and their forecast for 2022 and the next two years, Norma reports.

This year, the economy of Uzbekistan, as in other countries of the world, is gradually recovering from the crisis associated with COVID-19, as evidenced by the stabilization of the macroeconomic situation and the recovery of economic growth.

The main section of the publication presents the key directions of tax policy, the forecast of revenues, expenditures and the state budget deficit for the next year.

At the end of 2021, GDP growth is projected at 7% (1.7% in 2020). In 2022, the forecast for economic growth is 6% and the growth rate of the economy is expected to increase to 6.6% in 2024. The main factors of GDP growth in 2022 will be the recovery of the growth rates of the main sectors of the economy to pre-crisis values, an increase in the final consumption of households, investments in fixed assets, and an increase in the volume of export and import operations.

The main directions of tax and customs policy for 2022 have been presented.

So, the followings have been planned:

● preservation of rates for the main types of taxes;

● continuation of work on the abolition of ineffective tax and customs benefits;

● reduction of the tax rate on property of legal entities from 2% to 1.5%;

● indexation of property tax rates for individuals by 1.1 times;

● indexation of tax rates for the use of water resources (except for the rates established for the use of water for irrigating agricultural land and breeding fish) by 1.1 times;

● application of the coefficient 1.05 to the tax rate on the volume of water used for irrigation of agricultural land and for breeding fish);

● an increase in the marginal rates of depreciation charges attributed to expenses for tax purposes for:

- buildings – from 3 to 5%;

- structures – from 5 to 10%;

- transmission devices, power machines and equipment – from 8 to 15%;

- working machines and equipment – from 15 to 20%;

- computers and information processing equipment – from 20 to 40%.

● an increase in the size of the investment deduction by the amount of funds allocated for:

- purchase of new technological equipment – from 10 to 20%;

- expansion of production in the form of new construction – from 5 to 10%.

● preservation of the order of the carry forward of losses for ten years when calculating income tax with the removal of the limitation on the total amount of the carry forward.

In order to ensure the stability of the state budget revenues in 2022, the following rates will be maintained:

State budget expenditures for 2022 are planned at 214.8 trillion soums, or 25.6% of GDP (in 2021, they are expected to amount to 190.8 trillion soums, or 26.4% of GDP). To stimulate economic growth, it is planned to increase funds allocated for the implementation of sectoral development programs.

The publication ends with a section on public debt, which presents a forecast of the volume and structure of public debt for 2022, the cost of servicing it and other information.

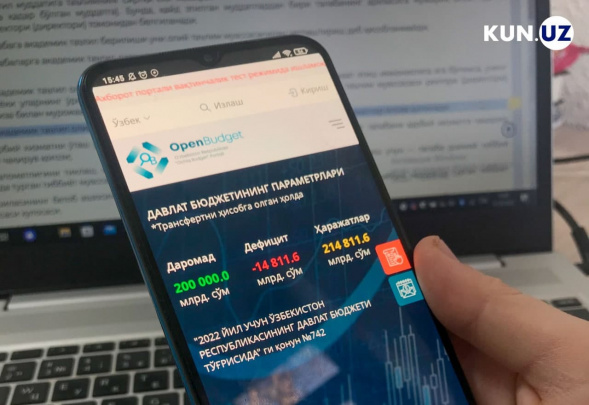

One can get acquainted with the budget for citizens on the official website of the Ministry of Finance, and on the information portal “Open Budget”.

Related News

11:48 / 04.07.2025

Second phase of “Initiative Budget” project to kick off on July 15

12:15 / 02.07.2025

IMF: Uzbekistan’s public-private partnerships could burden future budgets

11:25 / 21.06.2025

Government officials’ business trips and expenses to be monitored online

12:34 / 05.06.2025