Due to the reform of tax administration, implementation of advanced international practices, transparency and fairness will be achieved in the national tax system, the press service of the State Tax Committee reported.

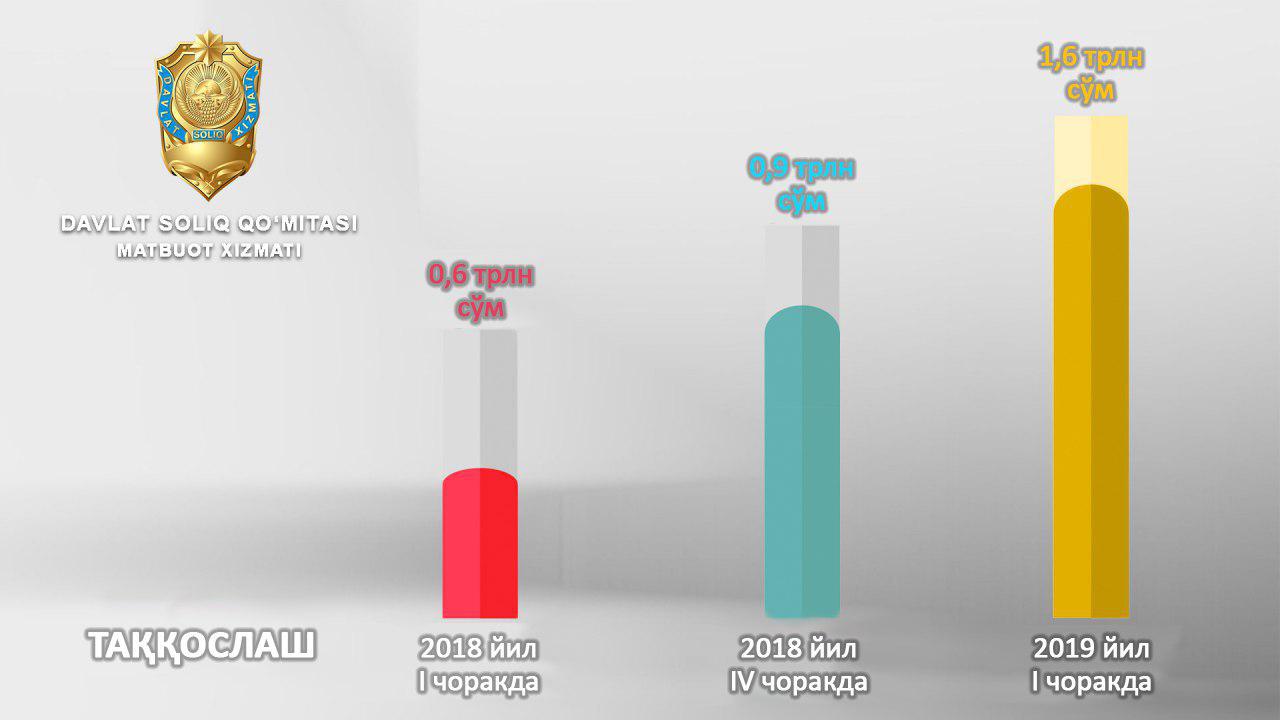

In the first quarter of this year, the budget revenues amounted to 18.4 trillion soums, which is 1.6 times more than in the same period last year.

The final tax revenues from individuals and legal entities also indicate that citizens are becoming more law-abiding. Thus, the value added tax revenues doubled in the first quarter of this year. The number of VAT payers has increased by 5 times, which means 35,000 business facilities.

Income tax is the main indicator of the chosen economic path. In the first quarter of this year, the indicator of revenues in comparison with the corresponding period of the previous year has increased by 2.6 times. The number of taxpayers increased by 5 times and exceeded 32,000.

At the same time, 49,700 legal entities have paid water tax for January-March of this year, which is 14.4 times more than in the previous year.

The number of land tax payers grew by 5.8 times over the period and amounted to 75,000 legal entities.

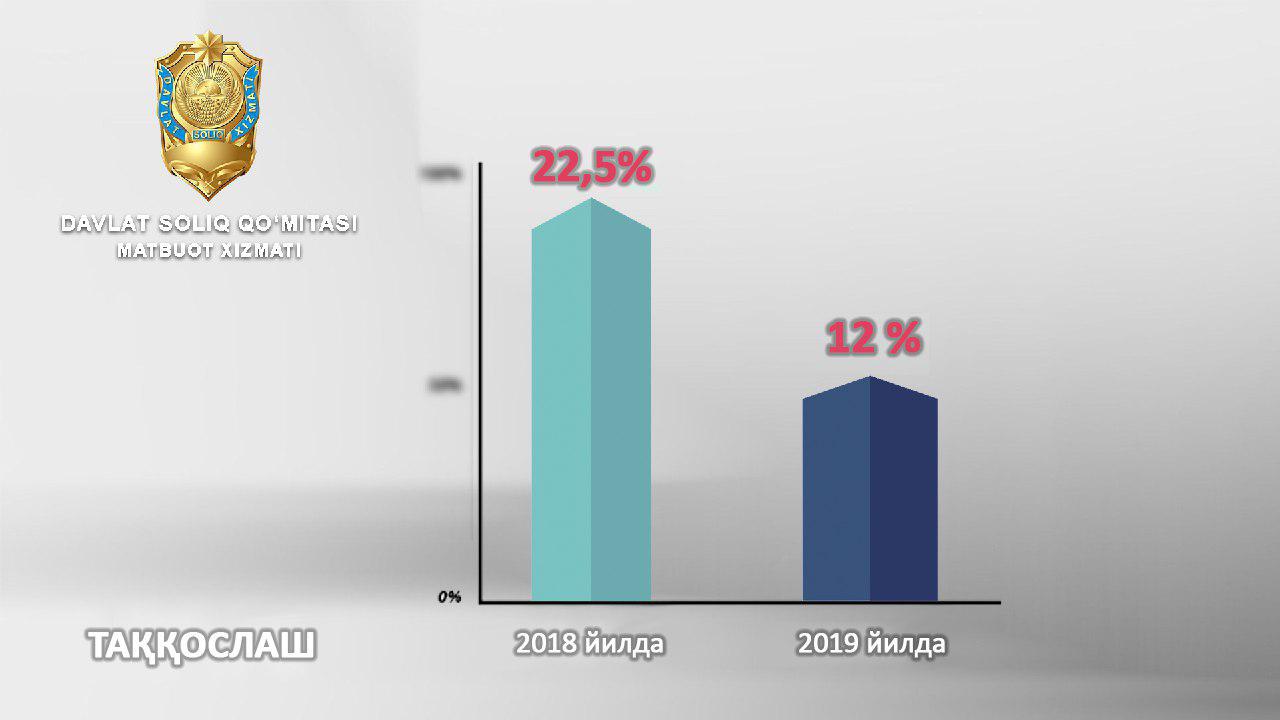

Starting from this year, introduction of a single tax rate of 12% on the income of individuals serves as an additional stimulus for legalization of workplaces.

Now, due to the reduction of the tax rate, the enterprises have 169 billion soums at the expense of reducing the burden on labor. 1.7 trillion soums remitted to the previous budget remain at workers.

Overall, the number of individuals paying income tax for the quarter reached 4.8 million people. Their number increased by 450,000 people or 10% more than in the same period last year.

“A new concept of the taxation system is built on the principles of transparency and fairness, equality of opportunity, which ensures formation of the sustainable state budget,” the STC press service noted.