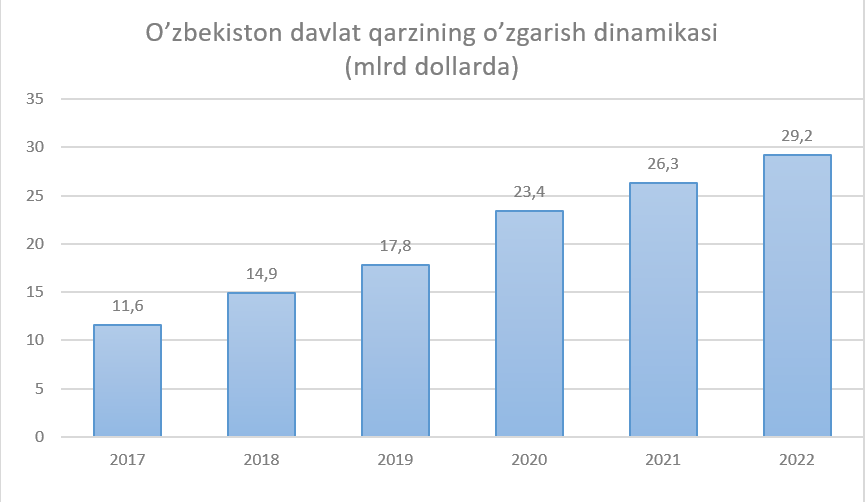

As of January 1, 2023, the state debt of Uzbekistan reached $29.2 billion. This is the highest indicator in the history of the country.

The public debt increased by 3.1 billion dollars compared to the 3rd quarter of 2022, and its share in GDP increased by 2.3% from 34.1% to 36.4%. For comparison, as of October 1, 2022, the state debt amounted to $26.2 billion.

Although the total amount of public debt is increasing from year to year, its share in relation to the gross domestic product has decreased in the period after 2020.

According to World Bank (WB) forecasts, the government of Uzbekistan is expected to continue to comply with its borrowing restrictions. Public debt and total external debt may gradually decrease to 32 and 55% of GDP by the end of 2024, respectively.

Why has the state’s external debt increased dramatically?

First, the scale of infrastructure projects in developing countries like Uzbekistan is constantly growing. To implement such tasks, the state has 2 alternative solutions: raising taxes or attracting foreign debt and investment funds.

Many developed countries prefer to choose the second way, given that increasing taxes will undermine the incentives for economic development in the future.

Second, the covid and post-covid era has led to an increase in external debt in many countries around the world. In particular, under the influence of these factors, it can be seen that the amount of debt attraction increased sharply in 2020 (from $17.8 billion to $23.4 billion).

Thirdly, the state budget deficit is increasing. In 2022, this figure was 3.9% of GDP or about 35 trillion soums.

In 2023, the total value of signed agreements on attracting foreign debt on behalf and under the guarantee of Uzbekistan will amount to $4.5 billion, of which $2 billion will be used to support the state budget, budget deficit (this is $500 billion less than last year), investment projects $2.5 billion (which is $500 million more than last year) will be attracted for financing.

Risks

As of October 1, 2022, 74.8% of the foreign currency portfolio of the state’s foreign debt is US dollars, 8.2% is Japanese yen, 7.7% is SDR (special drawing rights), 4.7% is euro, 1 8% – Uzbek soum, 2.8% – foreign debt in other currencies.

That is, more than 90% of the state debt was raised in foreign currency. Sudden changes in the exchange rate and possible depreciation of the Uzbek soum can have a significant impact on the cost and quantity of services.

Also, against the background of the global inflationary situation, tightening policies of Central Banks and interest rate hikes have sharply increased the cost of debt and capital in international markets. This makes it difficult for developing countries like Uzbekistan to attract foreign debt.

Earlier, Uzbekistan mainly borrowed foreign debt at fixed rates, but now it is forced to borrow funds at variable rates. This increases the risks.

For information, according to the law “On State Debt”, the maximum amount of the state debt in relation to the gross domestic product is determined not to exceed 60%. However, the 60% standard is only a recommendation given by international financial organizations and is not based on accurate and serious calculations.