The Tax Free system implies the return to foreign citizens of the amounts of VAT paid by them when purchasing certain types of goods from entrepreneurs engaged in retail trade in Uzbekistan. The list of goods covered by cashback is specified in the resolution of the Cabinet of Ministers dated November 8, 2022.

These are souvenirs, nuts, fruits and dried fruits, leather and fur products, carpets, textiles and much more.

To receive a VAT refund, one needs to be registered in the Soliq mobile application and scan receipts for his purchases in it. When departing at the airport, the passenger needs to check in for the flight, and then go to the Tax Free counter, presenting the boarding pass and the goods themselves.

The registered goods can be left for transportation in hand luggage, or you can return to the check-in counter and check in your luggage.

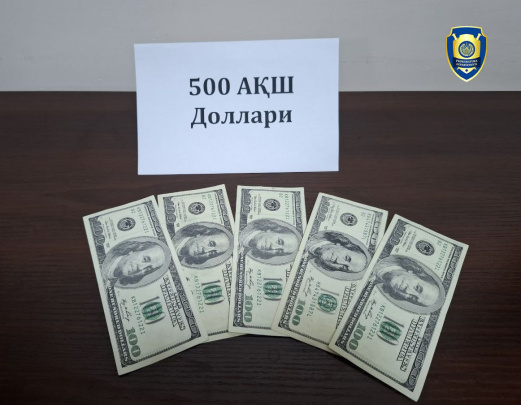

The total amount of the purchase of goods that fall under the Tax Free system must be at least 1 million soums. Also, the product must not be opened and used. Employees of the tax committee, after checking the compliance of the goods with all the criteria, draw up a cashback. For various categories of goods, the passenger can return up to 90% of the VAT amount. Cashback is issued to the passenger’s card and paid out after the 25th day of the month following the month in which the return was registered.